Payroll calculator 2023

The SAWW is the average weekly wage paid in New York State during the previous calendar year as reported by the Commissioner of Labor to the. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents.

Payroll Template Free Employee Payroll Template For Excel

If you employ for only 150 days in the year and the wages paid during that period is 630 000 your annualised wages total would be calculated as follows.

. To a maximum of 5000 business kilometres per car Deductions are. Product Services. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

2022 Payroll Deduction Calculator 2023 Payroll Deduction Calculator. Fall 2022 and Spring 2023. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

QuickBooks Payroll Software helps small businesses to run and manage payroll seamlessly and hassle-free. Try it save time and be compliant. Please select Full Year under the month drop down list if you would like a snapshot of Pay Schedules and Pay-dates for the whole year.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. The payroll tax rate reverted to 545 on 1 July 2022. 1320 effective 12312021 Next of Kin Affidavit OSC AC934P.

All calculations will be based on an full years income at the rate specified. This calculator allows you to calculate your estimated rate of payroll tax. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

These figures derive from a players payroll salary which includes the combination of a base salary incentives any signing bonus proration. Statewide Average Weekly Wage Paid Family Leave deductions and benefits are based on the New York Statewide Average Weekly Wage SAWW. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options tax allocations.

Information for Michigan State Universitys Controllers Office. The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. If your EOD falls between July 1 and December 31 you will receive your increment in July 2022.

In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12. This calculator is meant to help you estimate your tuition and fees costs FOR ONE SEMESTER.

2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011. 2022 San Diego Padres MLB playroll with player contracts options and future payroll commitments. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30.

And Attendance System Direct Deposit Form Extra Service and Dual Employment Internal Revenue Services IRS Withholding Calculator Minimum wage rate. If your EOD falls between January 1 and June 30 you will receive your increment in January 2023. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll.

Mileage calculation provided by the Australia Taxation Office - 78 cents per kilometre from 1 July 2022 for the 2022-2023 income year. Cash Payrolls Luxury Tax Payrolls. In the event of a conflict between the information from the Pay Rate Calculator and.

630 000 divided by 150 then multiplied by 365 or 366 days. Rates can be found on the Student Accounts web page. Fiscal Year 2023 beginning July 1 2022 is not a leap year.

We also offer a 2020 version. PenSoft Payroll is the best value in payroll software. Employment verifications may be sent to the Payroll Office 878-4124.

Use this simplified payroll deductions calculator to help you determine your net paycheck. But instead of integrating that into a general. The rate is based on annualised wages.

I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

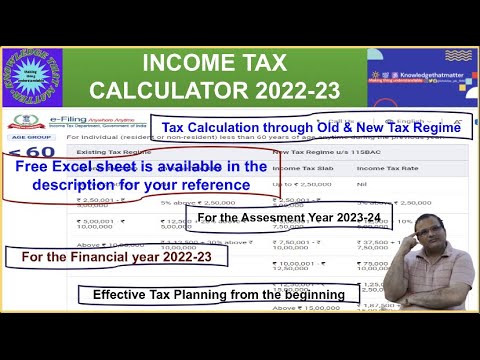

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

Uk Salary Calculator 2022 2023 By James Still

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Payroll Calendar Los Angeles City Controller Ron Galperin

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

Payroll Calculator Calculate Costs Of Hiring Staff In Latin America

Calculator And Estimator For 2023 Returns W 4 During 2022

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube